Also Refer: ACCOUNTS LATEST BOARD PAPER MARCH 2022 WITH SOLUTION.

HSC Accounts March 2020 Board Paper With Solution.

Book Keeping & Accountancy (50)

March 2020 Board Paper with Solution

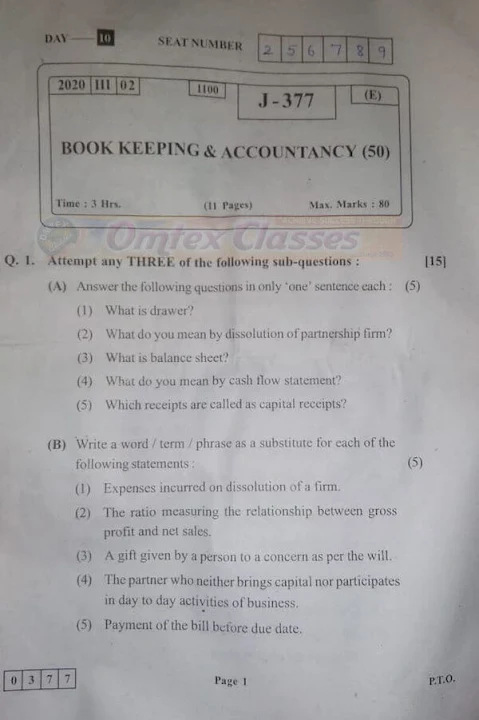

Q.1. Attempt any Three of the Following sub-questions:

(A) Answer the following questions in only 'one' sentence each. (5)

(1) Answer: The person who draws or makes the bill of exchange is called the drawer. He is the creditor. He will receive the money from the debtor.

(2) Answer: Dissolution means termination of the existing relationship between the partners of a firm. It means that the business will come to an end and the firm will wind up its business.

(3) Answer: A balance sheet is a statement showing the financial position of the firm at a particular date.

(4) Answer: A statement which shows inflow and outflow of cash and cash equivalents from operating, investing and financing activities during a specific period.

(5) Answer: Capital Receipts are those receipts which are non – recurring in nature and not forming a part of regular flow of income of a concern. E.g. specific donation received for construction of a building.

(B) Write a word / term / phrase as a substitute for each of the following statements: (5)

(1) Answer: Dissolution Expenses / Realisation Expenses

(2) Answer: Gross Profit Ratio

(3) Answer: Legacies

(4) Answer: Nominal partner.

(5) Answer: Retirement of Bill of Exchange

(C) Select the most appropriate alternative from the choices given below and rewrite the statements:

(1) Answer: Rs. 90,000

(2) Answer: 1881

(3) Answer: 5:2

(4) Answer: at discount

(5) Answer: 14th August, 2016

(D) State whether the following statements are True or False:

(1) Answer: False

(2) Answer: True

(3) Answer: False

(4) Answer: False

(5) Answer: True

(E) Prepare a format of Bill of Exchange from the following information. (5)

Book Keeping and Accountancy - Exam Papers

- Accounts - March 2025 - English Medium Download Answer Key

- Accounts - March 2025 - Marathi Medium Download Answer Key

- Accounts - March 2025 - Hindi Medium Download Answer Key

- Accounts - July 2025 - English Medium Download Answer Key

- Accounts - March 2024 English Medium Download Answer Key

- Accounts - March 2024 - Marathi Medium Download Answer Key

- Accounts - March 2024 - Hindi Medium Download Answer Key

- Accounts - July 2024 - English Medium Download Answer Key

- Accounts - March 2023 - English Medium Download Answer Key

- Accounts - July 2023 - English Medium Download Answer Key

- Accounts - March 2022 View

- Accounts - July 2022 Download Answer Key

- Accounts - March 2021 Download Answer Key

- Accounts - March 2020 View

- Accounts - March 2014 View

- Accounts - October 2014 View

- Accounts - March 2015 Download Answer Key

- Accounts - July 2015 View

- Accounts - March 2016 View

- Accounts - July 2016 View

- Accounts - July 2017 View

- Accounts - March 2017 View

- Accounts - March 2018 View

- Accounts - July 2018 View

- Accounts - March 2019 View

Single Entry Solution March 2020 Board Paper Accounts HSC

In the books of Shri Amar

Statement of Affairs as on 31st March, 2016.

| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

|---|---|---|---|

| Capital at the End of the Year. | 92245 | Cash | 4720 |

| Stock | 5125 | ||

| Bills Payable | 7400 | Debtors | 20000 |

| Creditors | 8150 | Prepaid Insurance | 300 |

| Bills Receivable | 15150 | ||

| Premises | 42400 | ||

| Vehicles | 20100 | ||

| Total | 107795 | Total | 107795 |

Statement of Profit or Loss For the year ended 31st March, 2016.

| Particulars | Amount Rs. | Amount Rs. |

|---|---|---|

| Capital at the end of the account year. | 92245 | |

| Add : Drawings | 5000 | |

| Less: Additional Capital introduced on 30th September, 2015 | 10000 | |

| Less: Capital at the beginning of the account year. | 70000 | |

| Trading Profit | 17245 | |

| Less: Depreciation On Vehicle On Premises |

2010 4240 |

6250 |

| Less: Bad debts | 1000 | |

| Less: R.D.D. @3% = (Debtor - Bad debts) x 3% = (20000 - 1000) x 3% = 19000 x 3% = Rs. 570 |

570 | |

| Less: Interest on Capital @ 5% On Opening Capital = 70000 x 5% = Rs. 3500 On Additional Capital = 10000 x 5% x (6 months) = Rs. 250 |

3750 | |

| Add: Creditors Written off | 3180 | |

| Net Profit | 8855 |

Admission of Partner Solution March 2020 Board Paper Accounts HSC

In the books of the Firm

Revaluation A/c

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To R.D.D. | 1000 | By Stock | 10000 |

| To Building | 10000 | ||

| By Loss on Revaluation Transferred to Partners Current A/c: Jayesh Current A/c ₹ 750 Kamal’s Current A/c ₹ 250 |

1000 | ||

| Total | 11000 | Total | 11000 |

Partners Current A/c

| Particulars | Jayesh | Kamal | Particulars | Jayesh | Kamal |

|---|---|---|---|---|---|

| To Profit and Loss Account | 3750 | 1250 | By Balance b/d | 3000 | 2000 |

| To Loss on Revaluation | 750 | 250 | By General Reserve | 3000 | 1000 |

| By Goodwill A/c | 15000 | 5000 | |||

| To Balance c/d | 16500 | 6500 | |||

| Total | 21000 | 8000 | Total | 21000 | 8000 |

Balance Sheet as on 1st April 2017

| Liabilities | Amt. ₹ | Amt. ₹ | Assets | Amt. ₹ | Amt. ₹ |

|---|---|---|---|---|---|

| Capital A/c | Building | 60000 | |||

| Jayesh | 60000 | (-) Depreciation | -10000 | 50000 | |

| Kamal | 50000 | Stock | 40000 | ||

| Vimal | 40000 | 150000 | (+) Appreciation | 10000 | 50000 |

| Sundry Creditors | 21000 | Sundry Debtors | 31000 | ||

| (-) R.D.D. | 1000 | 30000 | |||

| Current A/c | Cash Balance | 64000 | |||

| Jayesh | 16500 | ||||

| Kamal | 6500 | 23000 | |||

| Total | 194000 | Total | 194000 |

Cash A/c

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To Balance b/d | 4000 | ||

| To Partner Vimal’s Capital A/c | 40000 | ||

| To Goodwill A/c | 20000 | By Balance c/d | 64000 |

| Total | 64000 | Total | 64000 |

Goodwill A/c

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To Jayesh Capital A/c | 15000 | By Cash A/c | 20000 |

| To Kamal’s Capital A/c | 5000 | ||

| Total | 20000 | Total | 20000 |

Bills of Exchange Solution March 2020 Board Question.

Journal Entries in the books of Meenakshi (Drawer)

| Date | Particulars | Amount ₹ | Amount ₹ |

|---|---|---|---|

| 1st March 2016 | Neeta’s A/c ….. Dr. To Sales A/c [Being the goods are sold] |

40000 | 40000 |

| 1st March 2016 | Bills Receivable A/c … Dr. To Neeta’s A/c [Being the Bill is Drawn] |

40000 | 40000 |

| 31st May 2016 | Neeta’s A/c …. Dr. To Bills Receivable A/c [Being the bill is Dishonoured] |

40000 | 40000 |

| 31st May 2016 | Neeta’s A/c … Dr. To Interest A/c [Being the interest is charged on balance amount] |

60 | 60 |

| 31st May 2016 | Cash A/c … Dr. To Neeta’s A/c [Being the Part Payment is Made] |

10000 | 10000 |

| 31st May 2016 | Bills Receivable A/c … Dr. To Neeta’s A/c [Being the Bill is drawn for the balance amount including interest for 2 months] |

30060 | 30060 |

| 3rd August 2016 | Cash/ Bank A/c … Dr. To Bills Receivable A/c [Being the Bill is Honoured] |

30060 | 30060 |

In the Books of Meenakshi

Neeta’s A/c

| Date | Particulars | Amt. | Date | Particulars | Amt. |

|---|---|---|---|---|---|

| 1st March 2016 | To Sales a/c | 40000 | 1st March 2016 | By bills Receivable A/c | 40000 |

| 31st May 2016 | To Bills Receivable A/c | 40000 | 31st May 2016 | By Cash A/c | 10000 |

| 31st May 2016 | To Interest A/c | 60 | 31st May 2016 | By Bills Receivable A/c | 30060 |

| Total | 80060 | Total | 80060 |

Book-keeping and Accountancy 12th Standard HSC Maharashtra State Board. Latest Syllabus.