OMTEX AD 2

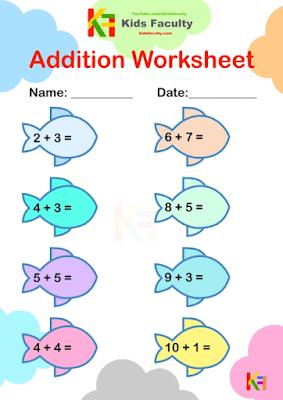

Free Addition Worksheets PDF for Kindergarten & Grade 1

Free Addition Worksheets

Explore our fun and engaging addition practice sheets for young learners. Click any worksheet to see a larger preview, or download the complete, print-ready PDF file for free!

You might also like: Free Preschool Alphabet Printables

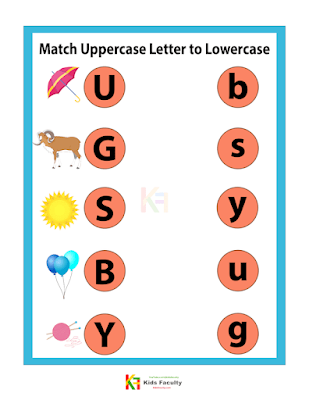

Free Match the Letters Worksheets for Preschool PDF

Free "Match the Letters" Worksheets

You Might Also Like:

Free Printable Matching Worksheets for Kids (PDF Download)

Free Printable Matching Worksheets

Here is a collection of our fun and educational matching worksheets. Click any preview to see a larger version or use the button below to download the complete PDF set.

You might also like:

PreSchool, A for Apple, B for Ball, Alphabets, छोटे बच्चों की पढ़ाईFree Printable Worksheets for Kids: PDF Downloads (Nursery to KG)

Addition

- Addition Worksheet.[5 Pages]

- Addition Worksheet.[5 Pages]

- Addition Worksheet.[36 Pages]

Subtraction

- Subtracting by Pictures[5 Pages]

- Subtracting by Numbers[5 Pages]

- Subtracting by Pictures and Numbers[5 Pages]

General Knowledge

- Fruits[6 Pages]

- Vegetables[6 Pages]

- Positions[7 Pages]

- Colors[10 Pages]

Match the following

- Match the fruit to its shadow[5 Pages]

- Match Letters[35 Pages]

- Match uppercase to lowercase[6 Pages]

Mathematics

- Multiplication Sheet practice[14 Pages]

Games

- Freak - Out !!![10 pages]

- Freak - Out !!![10 pages]

Literature

- Cursive Alphabet Trace and Write[26 Pages]

- Cursive Writing Small Letters[7 Pages]

- Capital Letters[26 Pages]

- Small Letters[26 Pages]

- Alphabet Trace[9 Pages]

- Alphabet Trace and Write[26 Pages]

- Alphabet Worksheet[26 Pages]

- CVC Flashcards[33 Pages]

Hindi PDF Download

- Hindi Alphabets (Swar)[13 Pages]

- Hindi Alphabets (Vanjan)[34 Pages]

Story PDF Download

- Two Cats and Clever Monkey[5 pages]

- The Lion and the Rabbit[4 Pages]

- The Lion and the Mouse[2 Pages]

Reading Passages

- Reading Passages for Kids[5 Pages]

Coloring PDF Download

- Alphabet Coloring[26 Pages]

- Coloring Images[12 Pages]

- English Alphabet Color it[5 Pages]

- Alphabet Color and Match[5 Pages]

- Alphabet Color it[26 Pages]

- Alphabet Color it 2[7 Pages]

- English Alphabet Color it 2[5 Pages]

Numbers PDF Download

- Numbers 1 to 10 Color it[2 Pages]

- 1 to 10 Numbers Coloring[4 Pages]

Flash Cards PDF Download

- Tell the Time Flash Cards[6 Pages]

- Flashcards English vocabulary[12 Pages]

- Alphabet Letters with Pictures[5 Pages]

- Numbers Flash Cards[5 Pages]

- Shapes FlashCards[4 Pages]

- Colors FlashCards[3 Pages]

- English Alphabet Learning Flash Cards[26 Pages]

- Alphabet Flashcards[26 Pages]

- Alphabet Identification Flash Cards[26 Pages]

Top Queries

a for apple b for ball pdf, a for apple pdf, a for apple b for ball book pdf, a for apple b for ball pictures pdf, a for apple b for ball worksheet pdf, a for apple b for ball, a for apple pdf download, a for apple b for ball chart pdf, a for apple b for ball image, a for apple coloring, b for ball coloring page, a for apple chart pdf download, a for apple printable, b for ball, alphabet with pictures pdf download, printable a for apple b for ball, a for apple b for ball picture, छोटे बच्चों की गिनती, english letter picture, b for ball images, a for apple chart pdf, english alphabet with pictures pdf, a for apple b for ball photo, ए फॉर एप्पल बी फॉर बॉल, a for apple b for ball images download, a for apple b for ball images, a for apple b for, a for apple images, apple b for ball, for apple b for ball, बी फॉर बॉल, apple b for, picture of alphabet, बच्चों की पढ़ाई गिनती, a for apple a for ball, एप्पल बी फॉर बॉल, letter a apple worksheet, ए फॉर एप्पल, a for apple b for ball worksheet, a for apple books, a for apple b for ball chart pdf download, printable b for ball, b for ball picture, printable a for apple, english alphabet pdf kids

English Grammar Test: Connectors and Nominalisation (30 Marks)

Unit Assessment: Grammar & Vocabulary

Connectors and Nominalisation

- Call me ________ you need money. (so that, in order that, in case)

- I forgot ________ I had to meet the Principal. (whether, that, if)

- ________ he is ninety years old, he is in the pink of health. (when, since, though)

- It is raining. Take an umbrella ________ you will get drenched. (or else, and, but)

- They faced many hardships ________ they are always cheerful. (although, nevertheless, otherwise)

- Both the minister ________ the officers visited the affected areas.

- Jaya teaches not only English ________ Science.

- Either Raghu ________ Bala will have to buy vegetables from the market.

- No sooner did I enter the house ________ it started drizzling.

- ________ he was honest, he was punished. (though, but)

- Walk carefully ________ you will fall down. (unless, otherwise)

- My mother called me ________ I was playing football. (or, while)

- My salary is low ________ I find the work interesting. (Nevertheless, similarly)

- The passengers rushed to board the bus ________ it arrived. (as soon as, as long as)

- beautiful

- breathe

- enter

- know

- accept

- dangerous

- The boy had to give a proper ________ for being late. (explain)

- He is an honest person. Everyone likes him.

- Sathya gave an explanation. The police wanted her to prove it.

- He speaks well. It attracts all.

- Suresh is always punctual and regular. It has earned him a good job.

- The policeman arrived quickly. It made us happy.

- as / I / healthy / are / you / am / as

- your / today / put on / new / since / is / birthday /dress / the

- allergic / dogs / Rani / though / is / to / of / six / she / them / has

- speaks / Ruben / besides / German / languages / two

- loan / apply / you / if / for / you / a / get / will / immediately / it

Answer Key & Explanatory Guide

- in case

- that

- Though

- or else

- nevertheless

- and

- but also

- or

- than

- Though

- otherwise

- while

- nevertheless

- as soon as

- beauty

- breath

- entry

- knowledge

- acceptance

- danger

- explanation

- Everyone likes him for his honesty.

- Though Sathya gave an explanation, the police wanted the proof.

- His speech is an attraction to all.

- Punctuality and regularity of Suresh have earned him a good job.

- The quick arrival of the policeman made us happy.

- I am as healthy as you are.

- Since today is your birthday, put on the new dress.

- Though Rani is allergic to dogs, she has six of them.

- Ruben speaks two languages besides German.

- If you apply for a loan, you will get it immediately.

(i) The Happy Prince: When, for, where, and, so.

(ii) Writer's draft: when, and, while, So.

(iii) Schools: and, Moreover, where, and, but, who, after.

(iv) Sister's Trip: decision, reservation, preference, information, arrival, departure.

(v) Androcles: punishment, hunger, enclosure, tearful, looking, Obviously, help.